Back

What’s Better for You? Fixed-Rate Mortgages vs Variable-Rate Mortgages

For first-time home-buyers, choosing the right mortgage can feel daunting. Here’s a classic example: Let’s say Jen and Jon Smith are taking the plunge with a three-bedroom, two-bath detached home in a mid-size Alberta city. But when it comes to their mortgage, they’re not sure which way to go between a fixed rate or variable rate mortgage. Which mortgage is right for them? What are the pros and cons? How do costs differ? The questions go on and on, and the short answer of “it depends” isn’t exactly comforting.

To make the best possible decision, the Smiths need to educate themselves about mortgage products and their short- and long-term impact on their finances, real estate and lifestyle and discuss the pros and cons with their mortgage broker and financial advisor.

Mortgages in 2019

“As mortgage brokers, we need to understand their current family, career, lifestyle and financial circumstances and consider their future plans and goals,” says Vancouver-based Rob Regan-Pollock, senior mortgage broker, Invis Inc., and co-chair of the Canadian Mortgage Brokers Association. “Of course, the short- and long-term financial cost of the mortgage is important, but they also need to look at their risk tolerance and need for flexibility since most Canadians move every 3.7 years or so.”

Fixed-Rate Mortgage Benefits

Across Canada, up to 70% of consumers are committing to fixed-rate rather than variable-rate mortgages. Right now the fixed rate, often 3% or less, is the cheaper option. Importantly, it also offers absolute predictability and peace-of-mind.

As Tracy Valko, a Mortgage Professionals of Canada director and the owner of mortgage brokerage Dominion Lending Centres Valko Financial Ltd., explains it, a fixed rate mortgage is a fully amortized mortgage loan with a set interest rate. As a result, mortgage payments remain exactly the same, whether Jen and Jon are paying $842.85 every week for five years or $4,962.25 every month for three years. If they break the mortgage term early, the penalty will be three months of interest (their fixed rate) or an Interest Rate Differential fee (the difference between the lender’s original interest rate and their current interest rate) – whichever is greater.

“Fixed rates are great for homeowners who need financial certainty and stable costs and expect to stay in that home for the length of their mortgage term,” says Wes Sudsbury, mortgage broker, Homeguard Funding, Newmarket, Ont. and president of the Canadian Mortgage Brokers Association’s Ontario Chapter’s board of directors. “Variable rates are better if they suspect they may sell or refinance before their mortgage term is up.”

Variable-Rate Flexibility

Variable interest rates fluctuate with changes to the Prime Lending Rate, which is determined by the Bank of Canada’s decisions regarding the overnight rate eight times a year or every 6.5 weeks. Until recently, a variable rate mortgage typically cost less than a fixed rate mortgage and homeowners paid lower penalties than if they were to break a fixed mortgage term. As interest rates change, regular payments will fluctuate with the lender adjusting the amount allotted to the principal and interest.

“You’re better off with a fixed rate, if you’re going to worry every time the Bank of Canada meets about the overnight rate,” says Sudsbury.

Playing the Mortgage Market

Mortgage experts know that life is unpredictable. A family that had no intention of moving before their mortgage term ends may need to relocate or refinance if circumstances change, for example, a pregnancy, a promotion or job loss, divorce or unexpected expenses.

While geography has no effect whatsoever on mortgage rates, local real estate markets may influence homeowners’ propensity to stay put or sell. If prices are dropping or rising rapidly as happened in Vancouver and Toronto very recently, they may be motivated to make a change and break their mortgage term early. Variable rate mortgages typically carry only a three-month simple interest penalty, which makes them a generally superior product for people who may need to break their mortgage term early.

“Homeowners that are more speculative and have an aggressive plan to climb the real estate ladder may be better off with a variable rate so they can more cost-effectively capitalize on the equity they’ve built,” says Regan-Pollock.

Homeowners with variable rate mortgages can lock in, but the fixed rate they pay will be based on current market conditions. They’ll also have to lock in for a term of equal or greater length than the term remaining on their variable mortgage. Many homeowners are shocked when they discover they can’t lock in at their current variable rate or choose the term.

Fixed-Rate or Variable-Rate?

When debating the pros and cons of fixed and variable rate mortgages, home buyers need to discuss several key factors with their mortgage brokers and financial advisors:

- How will penalties be charged? Lenders don’t calculate penalties to break a mortgage contract the same way. Make sure you understand the costs you’ll incur if you exit before maturity.

- Does the mortgage include restrictions such as prohibiting the transfer of the mortgage to another property to avoid penalties or banning a mid-term refinance with another institution?

- Can the homeowner obtain a payout or discharge statement if they are refinancing, and not selling their home? To keep homeowners until the end of the term, some ultra-low mortgage products contain clauses that let you break the mortgage only if the home is sold.

Jon and Jen’s unique life, financial, family and career circumstances will help them decide whether a fixed-or variable-rate mortgage makes the best sense for them. But they’re fictional - when it comes to real life, it’s important to do the research, crunch the numbers, and figure out what type of mortgage will put your mind at ease.

By: REW

GuidedBy is a community builder and part of the Glacier Media news network. This article originally appeared on a Glacier Media publication.

Location

Topics

Related Stories

-

Real Estate Vancouver

6 Apps that make home buying a smooth and convenient experience

So you’re ready to buy a new home. But as everyone knows, it’s not a simple process. There are a lot of moving pieces,...

-

Real Estate

Discover your dream home with a Kamloops Realtor

Sponsored Content Although we all wish buying or selling a house was as easy as signing a dotted line, there are many...

-

Real Estate

Millennials may rescue slow recreational real estate sales

A “ generational shift” in the recreational real estate market could help reverse a sharp decline in sales this year...

-

Home Inspection Vancouver

FAQs: What You Need to Know about Subject Removal

Subject removal is an important process during the real estate transaction that you need to be well versed in to ensure that...

-

Real Estate Richmond

How Realtor® Nari Thiara saved a home seller over $30,000

Sponsored Content In her 8 years with One Percent Realty, Nari Thiara estimates she’s managed to save her clients...

-

Real Estate Vancouver

Beware of real estate investment schemes promising tax write-offs, warns CRA

Canadians should beware of a spate of real estate investment schemes that falsely promise a significant tax write-off,...

-

Real Estate

Kamloops realtor helps make dream homes a reality

Sponsored Content For Connor Shelton, it’s all about making dream homes come true for his clients. That’s why the Kamloops...

-

Real Estate Vancouver

The Surprising Things Millennials Want when Buying a Home

It’s more challenging to become a homeowner in 2019 than it was for previous generations, but here’s some encouraging news:...

-

Real Estate Vancouver

Everything to Know about Presale Condo Risks

Presale and pre-construction condos seduce consumers with the promise of highly designed, sleek spaces but savvy home...

-

Real Estate Burnaby

Short-term rental taxes: What owners need to know

Since October 2018 when the legislation came into effect, short-term accommodation providers in B.C. have had to collect and...

-

Real Estate Richmond

Homebuyers sacrificing travel, leisure, retirement funds to build down payments

Funding a home purchase can be a monumental challenge in pricey Canadian cities such as Metro Vancouver – and for some, it...

-

Real Estate New Westminster

Multi-generational living, space-sharing and other Millennial home-buying hacks

Today’s Millennials want to get into homeownership, but high prices mean they are having to be creative about how to do so –...

-

Real Estate

Kamloops realtor helps make dream homes a reality

Sponsored Content For Connor Shelton, it’s all about making dream homes come true for his clients. That’s why the Kamloops...

-

Real Estate New Westminster

So you want to sell for land assembly

Sponsored Content Here are 5 things to consider so you get the best deal for yourself and your community. 1. Start with the...

-

Home Decor Vancouver

Refreshing Your Home for Spring/Summer

There are many ways you can refresh your house for the spring/summer season. These projects can provide your house with the...

-

Food & Drink Abbotsford

4 Dishes to Make with Summer Peaches

Summer is the perfect time of year to experiment with different ways to use peaches. These juicy, refreshing fruits can be...

-

Home & Garden Abbotsford

How to Create a Zero-waste Household

Reducing your household waste can help the planet in many ways. You may even be able to eliminate your waste completely if...

-

Beauty & Wellness Abbotsford

7 beauty trends for summer 2021

You may be looking forward to re-entering society this summer or at least looking better during a video meeting. Beauty trends...

-

Gifts Abbotsford

Four fabulous experience gift ideas for mom this Mother’s Day

If you’re tired of giving the same old types of Mother’s Day gifts, treat your mom with an experience instead. There are many...

-

Home Furniture & Decor Abbotsford

Working from home? 4 tips for your home office setup

Working from home can be a better experience for you with the right office setup. Setting up your in-home office correctly can...

-

Coffee Sales Vancouver

Everyone's whipping up dalgona coffee, the viral drink catching tons of buzz

Over the last couple of weeks, you might have noticed people posting photos of an unusual-looking coffee drink. What appears to...

-

Pets & Animals Vancouver

This virtual platform connects pet owners with veterinarians

If you are worried about the health of your pet during the COVID-19 pandemic, you are not alone. Whether you are too...

-

Delivery Vancouver

Stuck At Home? These BC Breweries Will Deliver Beer to Your Door

Thankfully, a number of B.C. craft breweries offer online sales, with delicious craft beer available to be delivered right to...

-

Design & Renovations Vancouver

How To Decorate Your Rental So It Feels Like Home

The right bath and hand towels can add energy to a room. Photo: Barb Lunter Older rental suites can sometimes be plagued...

-

Design & Renovations Vancouver

Spring Decor Tips to Refresh Your Space

Fresh flowers, topical coffee table books and garden ornaments used cleverly indoors are a few ways...

-

Healthy Living Vancouver

How To Be Ultra-Productive While Working Remotely

Canadians across the country set up laptops and cellphones to work from home on Monday to avoid COVID-19. While it’s a new...

-

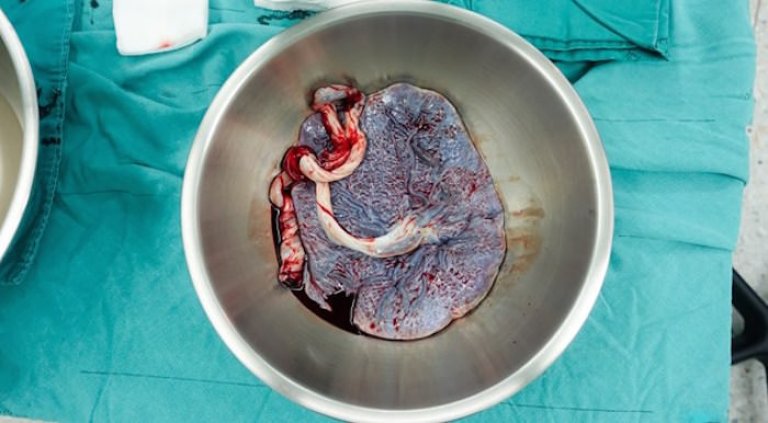

Healthcare Vancouver

B.C. research suggests no mental health benefits to eating your placenta

A new study published May 2 has suggested there are no mental health benefits to eating your placenta. The new research...

-

Catering Vancouver

40 years of perfecting the party

Four decades is a long time, and it is especially long in the competitive hospitality industry, which is cutthroat and not for...

-

Local Attractions Vancouver

8 awesome things to do in Whistler besides ski and snowboard

While skiing and snowboarding are a great deal of fun, Whistler offers a plethora of fun activities that you must try. From...

-

Wedding Experts Vancouver

Canada's Event Planning Star, Soha Lavin

You could say that event planning is in Soha Lavin’s blood. Indeed, the founder of Vancouver-based CountDown...

-

Food & Drink Vancouver

Chef Trevor Bird shares cooking tips and recipes for busy parents

We get it, parents are busy. In Vancouver at least, it’s typical that both parents work, which can make dinner time more than...